Uniform and Workwear Market Size By Geography (2025 to 2031)

As economies increasingly prioritize service industries, the demand for workwear and uniforms is rising. Driven by both economic shifts and regulatory requirements, the global workwear/uniforms market is estimated to be valued at $67.92 billion in 2025, with an expected annual growth rate of 4.30% from 2025 to 2031.

Leading the charge is the North American market, capturing over 40% of the market share with an estimated value of $26.70 billion in 2025, and projected to grow steadily at 2.5% annually from 2025 to 2031.

In this post, we’ll analyze the uniform and workwear market in different regions of the world. Our focus will be on market sizes, trends, major manufacturers, and the driving forces behind market growth across world regions.

Global Workwear and Uniform Industry Market Size

| Uniform and workwear Industry market size (2025) | $67.92 Billion |

| Forecast Period | 2025 to 2031 |

| CAGR | 4.30% |

| Projected growth By 2031 | $88.12 Billion |

| Regions covered | North America, South America, Europe, Middle East & Africa, and Asia Pacific. |

Industry analysts predict a positive trajectory in the coming years, with estimates suggesting a Compound Annual Growth Rate (CAGR) ranging from 4.3% to 5.8%.

The market is segmented into various product categories, with apparel (both general and protective) dominating the landscape. Footwear, too, is a significant segment with growing demand for safety footwear.

This positive outlook for the uniforms and workwear market presents opportunities for manufacturers, retailers, and distributors. As the global workforce continues to expand and safety regulations evolve, the need for high-quality work clothing is certain to rise.

We can back this growth by reviewing some financial data points about the leading players in the sector:

The market’s key player Cintas grew sales and adjusted EPS 51 of the past 53 years. The company has also increased its annual dividend each year since 1983.

Another Fortune 500 Company, Aramark generates over 20% of its revenue through its Uniform business.

Unifirst reached $2 billion in annual revenue in 2022, achieving a record in its financial performance. The company also averaged an annual increase of 6% in revenues and 7% in net income over the past 10 years.

Global Importance of Uniforms and Workwear

Uniforms and Workwear create a sense of professionalism and belonging and develop teamwork across workplaces. Studies even suggest uniforms can influence behavior, promoting adherence to company values.

Beyond that, uniforms are also a powerful branding tool. A well-designed uniform becomes instantly recognizable, solidifying brand identity and projecting a desired image.

The concept is evolving too. Modern uniforms prioritize comfort, style, and function, with breathable fabrics and a wider range of sizes. Some organizations even offer customization options. This focus on employee well-being and individuality leads to greater acceptance of uniforms.

In today’s workplace, uniforms are more than just clothes. They’re a way to build strong teams, enhance brand image, and create a safe, comfortable work environment.

Let’s have a look at the key factors driving the global uniform revolution.

Key drivers for the growth of uniforms and workwear market worldwide

Expanding Workforce and Industrialization

The increasing global workforce, particularly in economies like China and India, is driving the demand for work clothing. Rapid industrialization in these regions further fuels this demand.

Safety Regulations and Concerns

Heightened awareness around workplace safety regulations necessitates proper workwear in manufacturing, construction, and mining industries. Safety features in uniforms, including high-visibility materials and protective gear, as we move towards the first half of this decade.

Professionalism, Branding, and Image Enhancement

Uniforms are not only about safety but also serve as a means to project professionalism and brand identity. Companies are investing in uniforms that adhere to safety standards while reflecting their corporate image. This is particularly significant in sectors like healthcare, where strict hygiene regulations and professional appearance are paramount.

Fashion and Functionality

Advancements in technology are driving the development of more comfortable, lightweight, and stylish workwear. Workers increasingly seek uniforms that offer both functionality and aesthetics.

Cost-Effectiveness

Uniforms offer a cost-efficient solution for both employers and employees. Businesses save on laundry and replacement costs, while employees avoid the need to purchase work-appropriate clothing separately.

Healthcare Sector Demand

The healthcare industry’s need for specialized uniforms, such as scrubs and lab coats, is driven by strict hygiene regulations and the emphasis on a professional appearance.

Hospitality and Service Industry Expansion

Uniforms play a crucial role in providing a professional and cohesive experience in the hospitality and service sectors, including hotels, restaurants, and airlines. The growth of these industries directly contributes to the demand for uniforms.

North American Uniforms And Workwear Market (2025-2031)

| North American Uniform and workwear Industry market size (2025) | $26.70 billion |

| Forecast Period | 2025 to 2031 |

| CAGR | 2.50% |

| Projected growth By 2031 | $31.23 billion |

| Regions covered | The United States, Canada and Mexico. |

North America holds more than 40% of the global uniform and workwear market revenue with a market size of $26.70 billion in 2025.

Factors driving the uniform and workwear market growth in North America

The workwear and uniforms market in North America is experiencing steady growth in the manufacturing, construction, and healthcare sectors. The healthcare sector in particular is playing a significant role in market expansion, with a growing emphasis on protective clothing and scrubs.

The United States, in particular, plays a central role in North America’s growing Medical Scrub market.

Country-wise growth in North America

| Country | Uniform Market Size in 2025 | CAGR (2025-2031) |

|---|---|---|

| The United States | $21.07 billion | 2.30% |

| Canada | $3.2 billion | 3.30% |

| Mexico | $2.43 billion | 3.00% |

The United States is the leading player in the North American region with a market share of 78.8%.

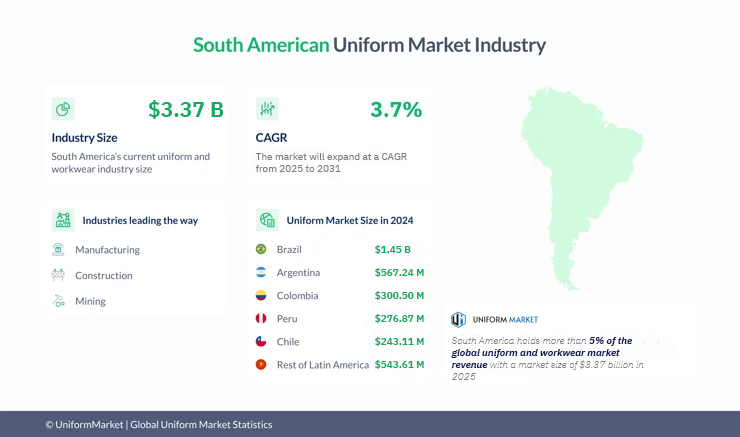

South American Uniforms And Workwear Market (2025-2031)

| South American Uniform and workwear Industry market size (2025) | $3.37 billion |

| Forecast Period | 2025 to 2031 |

| CAGR | 3.70% |

| Projected growth By 2031 | $4.18 billion |

| Regions covered | Brazil, Argentina, Colombia, Peru, Chile, and the rest of Latin America |

South America holds 5% of the global uniform and workwear market revenue with a market size of $3.37 billion in 2025.

Factors driving the uniform and workwear market growth in South America

The South American uniform market growth is primarily fueled by the region’s increasing industrialization, which has led to rising demand for specialized clothing across sectors such as manufacturing, construction, and mining.

South America’s safety laws and regulations are also driving the need for high-quality workwear to ensure compliance and reduce workplace accidents. Employers are also increasingly prioritizing employee well-being and understanding the importance of comfortable, yet durable uniforms.

Overall, there is a growing awareness of workplace safety, leading to the adoption of quality workwear solutions and reflecting South America’s commitment to improving worker productivity and safety standards.

Country-wise growth in South America

| Country | Uniform Market Size in 2025 | CAGR (2025-2031) |

|---|---|---|

| Brazil | $1.45 billion | 4.30% |

| Argentina | $567.24 million | 4.60% |

| Colombia | $300.50 million | 3.50% |

| Peru | $276.87 million | 3.90% |

| Chile | $243.11 million | 4.00% |

| Rest of Latin America | $543.61million | $2.8% |

Brazil is the biggest market for Uniforms and Workwear in the South American region with a market share of 43.07%.

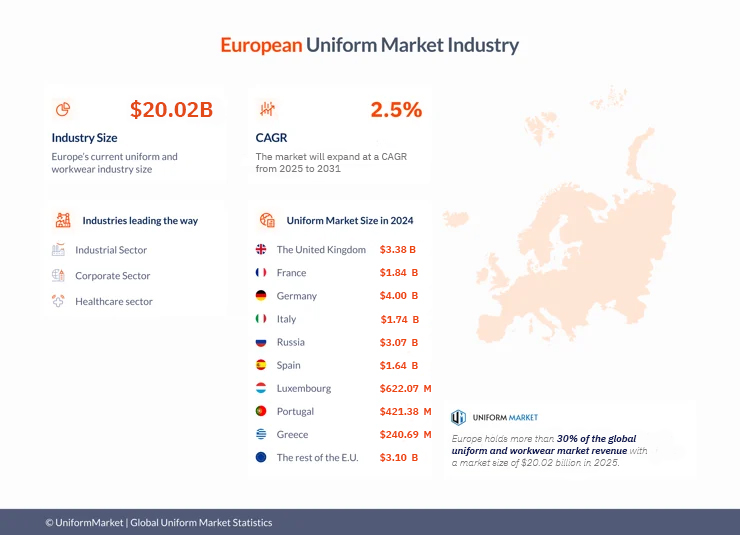

European Uniforms And Workwear Market (2025-2031)

| European Uniform and workwear Industry market size (2025) | $20.02 billion |

| Forecast Period | 2025 to 2031 |

| CAGR | 2.50% |

| Projected growth By 2031 | $23.30 billion |

| Regions covered | The UK, France, Germany, Italy, Russia, Spain, Luxembourg, Portugal, Greece, rest of the E.U. |

Europe holds 30% of the global uniform and workwear market revenue with a market size of $20.02 billion in 2025.

Factors driving the uniform and workwear market growth in Europe

Strong safety regulations by European legislation make businesses invest in high-quality workwear and that’s the main driver behind the growth of the uniform and workwear market growth in the region. This growth is further pushed by the region’s advancing industrial landscape.

Businesses, recognizing the intrinsic link between employee well-being and productivity, are increasingly prioritizing the provision of comfortable and durable uniforms. The European corporate workwear sector (especially in Germany) is also experiencing a significant expansion.

This collective focus on safety, innovation, worker welfare, and the growing corporate sector makes Europe the second biggest market in the uniform and workwear industry.

Country-wise growth in Europe

| Country | Uniform Market Size in 2025 | CAGR (2025-2031) |

|---|---|---|

| The United Kingdom | $3.38 billion | 3.60% |

| France | $1.84 billion | 2.00% |

| Germany | $4 billion | 3.00% |

| Italy | $1.74 billion | 2.20% |

| Russia | $3.07 billion | 1.90% |

| Spain | $1.64 billion | $2.8% |

| Luxembourg | $622.07 million | 2.90% |

| Portugal | $421.38 million | 2.60% |

| Greece | $240.69 million | 3.10% |

| The rest of the E.U. | $3.10 billion | 1.50% |

The United Kingdom (especially England) has the potential of reaching $4.2 billion in market size by 2031. Currently, the UK market sits at $3.38 billion.

The German market backed by its business growth is the second fastest uniform market in the region. Deutschland is forecasted to have a CAGR of 2.6% between 2025 and 2031 reaching a market value of $4.78 billion by 2031.

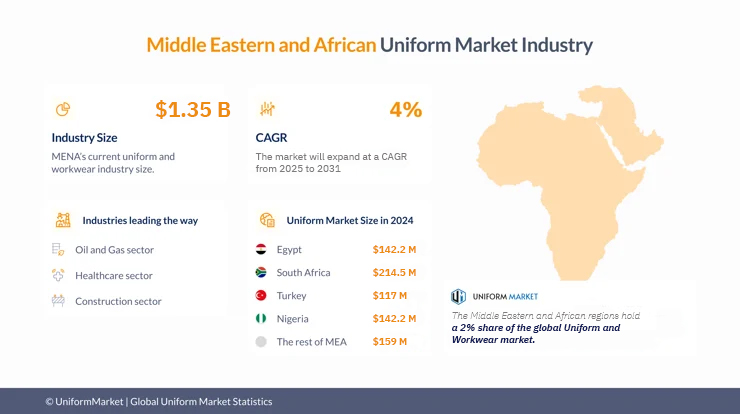

Middle East and Africa Uniforms And Workwear Market (2025-2031)

| Middle East and Africa Uniform and workwear Industry market size (2025) | $1.35 billion |

| Forecast Period | 2025 to 2031 |

| CAGR | 4% |

| Projected growth By 2031 | $1.7 billion |

| Regions covered | Egypt, South Africa, Turkey, Nigeria, and the rest of MEA. |

The Middle Eastern and African regions hold a 2% share of the global Uniform and Workwear market.

Factors driving the uniform and workwear market growth in the Middle East and Africa

The uniform and workwear market in the Middle East and Africa is witnessing significant growth due to its oil and gas industry. These sectors necessitate specialized attire to ensure safety and operational efficiency. We can’t overlook the boom of the healthcare sector in this region too. And finally, add substantial investments in infrastructure projects to the mix.

The Gulf Cooperation Council (GCC) countries, with their focus on stringent safety standards and workforce welfare, profoundly influence uniform demand across the MEA region.

Country-wise growth in the Middle East and Africa

| Country | Uniform Market Size in 2025 | CAGR (2025-2031) |

|---|---|---|

| Egypt | $142.2 million | 4.30% |

| South Africa | $214.5 million | 5.00% |

| Turkey | $117 million | 3.50% |

| Nigeria | $142.2 million | 3.10% |

| The rest of MEA | $159 million | 3.00% |

South Africa has a growth potential of reaching $290 million in market value by 2031.

Asia Pacific Uniforms And Workwear Market (2025-2031)

| Asia Pacific Uniform and workwear Industry market size (2025) | $15.91 billion |

| Forecast Period | 2025 to 2031 |

| CAGR | 6.30% |

| Projected growth By 2031 | $22.93 billion |

| Regions covered | China, Japan, India, South Korea, Australia, South East Asia, Rest of Asia Pacific. |

The Asia Pacific region holds 23% of the global uniform and workwear market share. Asia Pacific market also has the fastest CAGR over the forecast period.

Factors driving the uniform and workwear market growth in the Asia Pacific

China and India are the two major countries driving the increase in Asia Pacific’s uniform and workwear market. China and India also have the world’s largest labor force. The boom of the workwear market in these regions is inevitable.

In the bigger picture, the Asia Pacific’s growing manufacturing sectors demand specialized workwear for various industries, especially in automotive and construction.

As the regional economy progresses and urbanization speeds up, more businesses and organizations will seek customized workwear, creating extensive room for growth in the workwear market. By 2031, the total revenue of the workwear market in the Asia Pacific region is forecasted to rise to $22.93 billion.

Country-wise growth in the Asia Pacific

| Country | Uniform Market Size in 2025 | CAGR (2025-2031) |

|---|---|---|

| China | $6.81 billion | 5.80% |

| Japan | $2.08 billion | 4.80% |

| India | $1.84 billion | 8.10% |

| South Korea | $1.6 billion | 5.40% |

| Australia | $790 million | 6% |

| South East Asia | $1.06 billion | 7.30% |

| Rest of Asia Pacific | $1.07 billion | 6.10% |

Indian uniform and workwear market has the potential for the fastest growth with a CAGR of over 8%. The market is mainly driven by the automotive revolution in the country.

Source: The data in this report is mainly sourced from CMR’s global and regional reports on the uniform and workwear market.